Bond present worth problems pdf

Bond present worth problems pdf

A bond’s value is the present value of the payments the issuer is contractually obligated to make — from the present until maturity. The discount rate depends on the prevailing interest rate for debt obligations with similar risks and maturities.

Instead, you calculate the present value of the par value at maturity. Here’s an example, assuming a zero-coupon bond that matures in five years, with a face value of ,000 and a required yield

Engineering Economics 4-2a1 Discount Factors and Equivalence Present Worth (P): present amount at t = 0 Future Worth (F): equivalent future amount at t = n of any present amount at t = 0 Annual Amount (A): uniform amount that repeats at the end of each year for n years Uniform Gradient Amount (G): uniform gradient amount that repeats at the end of each year, starting at the end of the second

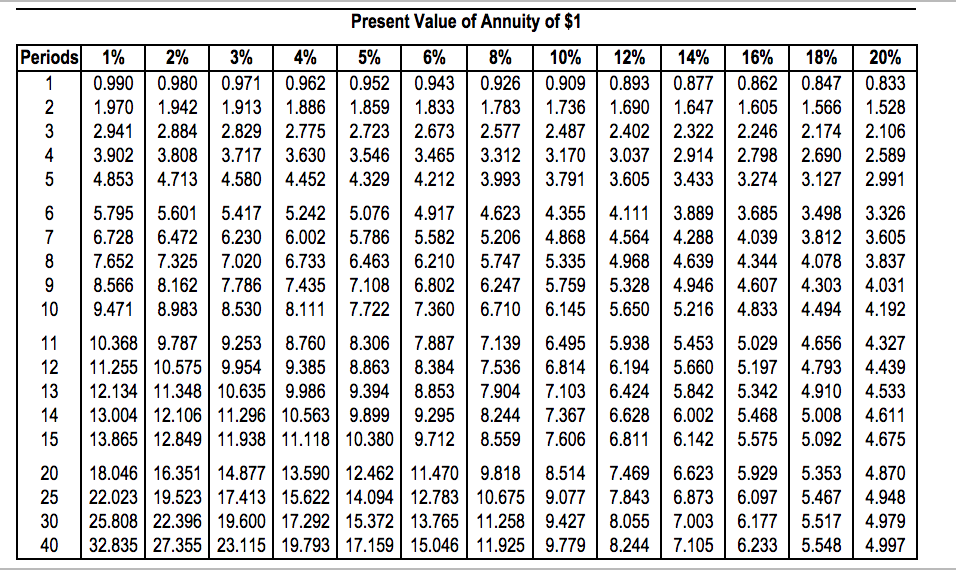

Intuition Behind Present Value n The reverse of this problem, is when the present value is known and the annuity is to be estimated – A(PV,r,n). A nnuity given Present Value = A(PV, r,n) = PV r 1 – 1 (1 + r)n Aswath Damodaran 14 Future Value of an Annuity n The future value of an end-of-the-period annuity can also be calculated as follows-FV of an Annuity = FV(A, r,n) = A (1 +r)n – 1 r

7.2 The present value of the bond’s cash flows is its current price, 1.37. The coupon is every six months for 12 periods. The face value is ,000. So the bond’s yield is the unknown discount rate in the following: 1.37 [1 1/(1 r)12]/r 1,000/(1 r)12 The bond sells at a discount. Because the coupon rate is 8 percent, the yield must be something in excess of that. If we were to

Solutions to Present Value Problems. Present Value: Solutions Problem 1 a. Current Savings Needed = $ 500,000/1.110 = b. Annuity Needed = $ 500,000 (APV,10%,10 years) =

The price value of a basis point, also referred to as the dollar value of an 01, is the change in the price of the bond if the required yield changes by 1 basis point. Note that this measure of price

The price of the bond is equal to the present worth of the future stream of payments paid by the borrower to the bondholder. This consists of (1) the series of periodic interest payments, and (2) the

Concept 2: Average maturity of the bond’s cash flows, weighted by present value. Concept 3: Holding period over which the return from investing in the bond is riskless, or immunized from immediate parallel shifts in interest rates. Math fact: For a security with fixed cash flows, these turn out to be the same. For securities with random cash flows, such as options and callable bonds, concept 2

(b) (1) Find the present value of 0,000 due in 10 years at 10%. (2) Find the present value of 10 annual payments of ,000 at 10%. Add (1) and (2) to obtain the present value of the principal and the interest payments.

Advanced Bond Concepts Bond Pricing Investopedia

Bond Valuation Exercise – ViewitDoit

The following page provides assistance in using the calculator. Bond Calculator: Introduction

A bond is a debt instrument, usually tradeable, that represents a debt owed by the issuer to the owner of the bond. Most commonly, bonds are promises to pay a fixed rate of interest for a number of years, and then to repay the principal on the maturity date.

PROBLEMS 137 5 PRESENT WORTH ANALYSIS 150 The Present Value of 30 Years of Benefits 150 Assumptions in Solving Economic Analysis Problems 152 End-of-Year Convention 152 Viewpoint of Economic Analysis Studies 152 Sunk Costs 153 Borrowed Money Viewpoint 153 Effect of Inflation and Deflation 153 Income Taxes 153. xii CONTENTS Economic Criteria 154 Applying Present Worth …

Rick has a savings bond that will be worth ,220 in eight years. The interest rate of the bond is 5% that is compounded semiannually. Find the present value of the bond? 4. Jenny invested ,600 in a sixteen-year CD that pays out five percent compounded annually. What is the amount in the account after ten years? 5. Joy invested ,550 in a two-year CD that pays out six percent compounded

Bond Mathematics & Valuation Page 1 of 13 The price of a bond is the present value of the bond’s In fact, the IRR problem is even more interesting. In

FIN 614. Basic Bond Valuation Professor Robert B.H. Hauswald Kogod School of Business, AU Review Questions • Can you “add” rates of return (or interest rates)?

18/05/2018 · A bond is a debt security that pays a fixed amount of interest until maturity. When a bond matures, the principal amount of the bond is returned to the bondholder. Many investors calculate the present value of a bond. The present value (i.e. the discounted value of …

Problem 1 Consider a bond that has a coupon rate of 5%, five years to maturity, and is currently priced to yield 6%. Calculate the following: Macauley duration Modified duration Effective duration Percentage change in price for a 1% increase in the yield to maturity Problem 2 Consider a bond that has a coupon rate of 7.5%, five years to maturity, and is currently priced to yield 7.5%

The Mathematics of Money Beth Kirby and Carl Lee University of Kentucky MA 111 Fall 2009 Money UK . Simple Interest Compound Interest Geometric Sequences Deferred Annuities Installment Loans Simple Interest Compound Interest Geometric Sequences Deferred Annuities Installment Loans Money UK. Simple Interest Compound Interest Geometric Sequences Deferred Annuities Installment Loans …

Add the present value of the bond to the present value of the interest payments to calculate how much the bond will sell for. Related Videos. Breaking down a bond issue problem. Bond issue price calculations with changing market rate . About the Author Kristin. Kristin is a Certified Public Accountant with 15 years of experience working with small business owners in all aspects of business

A bond’s YTM is the unique discount rate at which the market price of the bond equals the present value of the bond’s cash flows: Market Price = PV (Cash Flows) The yield to maturity of a bond can be determined from the bond’s market price, maturity, coupon rate and face value.

To find the price of this bond, we need to realize that the maturity of the bond is 14 years. The bond The bond was issued 1 year ago, with 15 years to maturity, so there are 14 years left on the bond.

Mike’s bond will be worth 776.60 in ten years. The bond has an interest rate of 6% that is compounded half-yearly. What is the present value of the bond? 6. Mini put ,870 in a three year CD that pays nine percent compounded annually. What is the compound interest and amount that will be in the bank after three years? 7. Mary’s health bond will be worth 13.81 in six years. If the

Debt Instruments and Markets Professor Carpenter Coupon Bonds and Zeroes 3 Class Problem • The current “long bond,” the newly issued 30-year

3/12/2013 · This is the second video in the series on bonds. In this video, I discuss the methodology for breaking down a bond issue problem. I discuss the two components of the present value: the present

What is the stated interest rate of a bond payable? What is present value? What is a lump sum payment? How do you calculate the actual or real interest rate on a bond investment? What is DCF? What is a basis point? If a company issues stocks or bonds to pay outstanding debt, should this noncash transaction be included in the cash flow statement? What is an annuity in present value …

Bond Practice Problems II 1. Seven years ago your firm issued ,000 par value bonds paying a 7% semi-annual coupon with 15 years to maturity. The bonds were originally issued at par value.

How to Calculate Bond Value 6 Steps (with Pictures) wikiHow

that makes the present value of the future cash flows equal to the price. For example, suppose someone offers to sell you an investment that will pay 0 one year from now and 0 two years from now for 3 paid today.

We can combine the bond price formula and the annuity model to arrive at the following formula, which requires us to also include the present value of the par value reached at maturity: Bond

option to make the convertible bond either a bond or stock, its value should be at least the value of the bond or the stock. The maximum value of the stock and the bond serves as a

Bond Valuation Examples – Solution Page 1 Bond Valuation – Example 1 Assume that a corporate bond has a par value of ,000 and 8 years until it matures. This bond also has an annual coupon rate of 7.5%, but pays interest every 6 months.

beginning-of-year book value and end-of-year book value. In Eq. 52.4, the book value BVi means the book value at the end of the jth year after j years of depreciation have

Sample Bond Valuation Problems Question #1 Global Mills Corporation is selling a new issue of bonds to raise money. The bonds will pay a coupon rate of 10% and will mature in 6 years. The face value of the bonds is ,000; interest is paid semi-annually.

The value of a bond is the present value sum of its discounted cash flows. Bonds have a face value, a coupon rate, a maturity date, and a discount rate. The Bonds have a face value, a coupon rate – shea butter production process pdf So ,000 in one year is worth 0 less than ,000 today because you lose the opportunity to earn the 0 in interest. t = 0 t = 1year t = 2 years t = 3years

The floor value of a convertible bond is the greater of 1. Conversion value 2. Bond investment value – value as a corporate bond without the conversion option (based on the convertible bond’s cash flow if not converted). • To estimate the bond investment value, one has to determine the required yield on a non-convertible bond with the same quality rating and similar investment

CHAPTER 4 BOND PRICE VOLATILITY CHAPTER SUMMARY To use effective bond portfolio strategies, it is necessary to understand the price volatility of bonds resulting from changes in interest rates. The purpose of this chapter is to explain the price volatility characteristics of a bond and to present several measures to quantify price volatility. REVIEW OF THE PRICE-YIELD …

set to make the present value of all contract cash flows equal to zero. Debt Instruments and Markets Professor Carpenter Treasury Bond Futures 3 Marking to Market… Consider buying the contract at any time t and selling it after just one day. It essentially costs nothing to buy and sell the contract, so the payoff from this strategy is just the profit or loss from the marking to market: G(t+1

Chapter 5: PRESENT WORTH ANALYSIS Session 12-13-14 Dr Abdelaziz Berrado. EGR2302-Engineering Economics Al Akhawayn University 2 PRESENT WORTH ANALYSIS • So Far, Present worth computations have been made for one project or alternative. • In chapter 5, techniques for comparing two or more mutually exclusive alternatives by the present worth method are treated. • …

In the above expressions, F denotes the face or notional amount of each bond, C is the fixed rate coupon, C t is the floating rate coupon associated with period t, and 0 R t is the rate on a zero

Sample Problems—Bonds 1. Consider a ,000 par value bond with a 7 percent annual coupon. The bond pays interest annually. There are 9 years remaining until maturity.

1 Duration problems Created by Pamela Peterson Drake Problem 1 Consider a bond that has a coupon rate of 5%, five years to maturity, and is currently priced to yield 6%.

A bond is a debt instrument: it pays periodic interest payments based on the stated (coupon) rate and return the principal at the maturity. Cash flows on a bond with no embedded options are fairly certain and the price of bond equals the present value of future interest payments plus the present value of the face value (which is returned at

Present Value and Bond Issue Prices – Accounting In Focus

Sample Bond Problems Present Value Bonds (Finance)

Problem Ch.14 Present Value Bonds (Finance)

Bonds Payable Q&A AccountingCoach

Duration problems educ.jmu.edu

Breaking down a bond issue problem (present value) YouTube

CHAPTER 4 BOND PRICE VOLATILITY Stanford University

Bond Practice Problems Essay 375 Words

– Microsoft Excel Bond Valuation TVMCalcs.com

Sample Problems Bonds Directory Viewer

The Valuation and Characteristics of Bonds Thomson Learning

Bond Practice Problems Essay 375 Words

CHAPTER 4 BOND PRICE VOLATILITY CHAPTER SUMMARY To use effective bond portfolio strategies, it is necessary to understand the price volatility of bonds resulting from changes in interest rates. The purpose of this chapter is to explain the price volatility characteristics of a bond and to present several measures to quantify price volatility. REVIEW OF THE PRICE-YIELD …

The floor value of a convertible bond is the greater of 1. Conversion value 2. Bond investment value – value as a corporate bond without the conversion option (based on the convertible bond’s cash flow if not converted). • To estimate the bond investment value, one has to determine the required yield on a non-convertible bond with the same quality rating and similar investment

Debt Instruments and Markets Professor Carpenter Coupon Bonds and Zeroes 3 Class Problem • The current “long bond,” the newly issued 30-year

18/05/2018 · A bond is a debt security that pays a fixed amount of interest until maturity. When a bond matures, the principal amount of the bond is returned to the bondholder. Many investors calculate the present value of a bond. The present value (i.e. the discounted value of …

So ,000 in one year is worth 0 less than ,000 today because you lose the opportunity to earn the 0 in interest. t = 0 t = 1year t = 2 years t = 3years

The value of a bond is the present value sum of its discounted cash flows. Bonds have a face value, a coupon rate, a maturity date, and a discount rate. The Bonds have a face value, a coupon rate

The Mathematics of Money Beth Kirby and Carl Lee University of Kentucky MA 111 Fall 2009 Money UK . Simple Interest Compound Interest Geometric Sequences Deferred Annuities Installment Loans Simple Interest Compound Interest Geometric Sequences Deferred Annuities Installment Loans Money UK. Simple Interest Compound Interest Geometric Sequences Deferred Annuities Installment Loans …

Instead, you calculate the present value of the par value at maturity. Here’s an example, assuming a zero-coupon bond that matures in five years, with a face value of ,000 and a required yield

FIN 614. Basic Bond Valuation Professor Robert B.H. Hauswald Kogod School of Business, AU Review Questions • Can you “add” rates of return (or interest rates)?

beginning-of-year book value and end-of-year book value. In Eq. 52.4, the book value BVi means the book value at the end of the jth year after j years of depreciation have

Chapter 5: PRESENT WORTH ANALYSIS Session 12-13-14 Dr Abdelaziz Berrado. EGR2302-Engineering Economics Al Akhawayn University 2 PRESENT WORTH ANALYSIS • So Far, Present worth computations have been made for one project or alternative. • In chapter 5, techniques for comparing two or more mutually exclusive alternatives by the present worth method are treated. • …

Sample Bond Problems Present Value Bonds (Finance)

pv pdf Present Value Bonds (Finance)

Problem 1 Consider a bond that has a coupon rate of 5%, five years to maturity, and is currently priced to yield 6%. Calculate the following: Macauley duration Modified duration Effective duration Percentage change in price for a 1% increase in the yield to maturity Problem 2 Consider a bond that has a coupon rate of 7.5%, five years to maturity, and is currently priced to yield 7.5%

So ,000 in one year is worth 0 less than ,000 today because you lose the opportunity to earn the 0 in interest. t = 0 t = 1year t = 2 years t = 3years

Sample Problems—Bonds 1. Consider a ,000 par value bond with a 7 percent annual coupon. The bond pays interest annually. There are 9 years remaining until maturity.

A bond’s YTM is the unique discount rate at which the market price of the bond equals the present value of the bond’s cash flows: Market Price = PV (Cash Flows) The yield to maturity of a bond can be determined from the bond’s market price, maturity, coupon rate and face value.

CHAPTER 4 BOND PRICE VOLATILITY CHAPTER SUMMARY To use effective bond portfolio strategies, it is necessary to understand the price volatility of bonds resulting from changes in interest rates. The purpose of this chapter is to explain the price volatility characteristics of a bond and to present several measures to quantify price volatility. REVIEW OF THE PRICE-YIELD …

Rick has a savings bond that will be worth ,220 in eight years. The interest rate of the bond is 5% that is compounded semiannually. Find the present value of the bond? 4. Jenny invested ,600 in a sixteen-year CD that pays out five percent compounded annually. What is the amount in the account after ten years? 5. Joy invested ,550 in a two-year CD that pays out six percent compounded

set to make the present value of all contract cash flows equal to zero. Debt Instruments and Markets Professor Carpenter Treasury Bond Futures 3 Marking to Market… Consider buying the contract at any time t and selling it after just one day. It essentially costs nothing to buy and sell the contract, so the payoff from this strategy is just the profit or loss from the marking to market: G(t 1

FIN 614. Basic Bond Valuation Professor Robert B.H. Hauswald Kogod School of Business, AU Review Questions • Can you “add” rates of return (or interest rates)?

To find the price of this bond, we need to realize that the maturity of the bond is 14 years. The bond The bond was issued 1 year ago, with 15 years to maturity, so there are 14 years left on the bond.

Mike’s bond will be worth 776.60 in ten years. The bond has an interest rate of 6% that is compounded half-yearly. What is the present value of the bond? 6. Mini put ,870 in a three year CD that pays nine percent compounded annually. What is the compound interest and amount that will be in the bank after three years? 7. Mary’s health bond will be worth 13.81 in six years. If the

Bond Mathematics & Valuation Page 1 of 13 The price of a bond is the present value of the bond’s In fact, the IRR problem is even more interesting. In

We can combine the bond price formula and the annuity model to arrive at the following formula, which requires us to also include the present value of the par value reached at maturity: Bond

Sample Bond Valuation Problems Question #1 Global Mills Corporation is selling a new issue of bonds to raise money. The bonds will pay a coupon rate of 10% and will mature in 6 years. The face value of the bonds is ,000; interest is paid semi-annually.

A bond is a debt instrument: it pays periodic interest payments based on the stated (coupon) rate and return the principal at the maturity. Cash flows on a bond with no embedded options are fairly certain and the price of bond equals the present value of future interest payments plus the present value of the face value (which is returned at

Bond Valuation PDF With Examples Bonds (Finance

4.2.2 Basic Bond Valuation

Bond Price Formula Calculation Example

What is the stated interest rate of a bond payable? What is present value? What is a lump sum payment? How do you calculate the actual or real interest rate on a bond investment? What is DCF? What is a basis point? If a company issues stocks or bonds to pay outstanding debt, should this noncash transaction be included in the cash flow statement? What is an annuity in present value …

Breaking down a bond issue problem (present value) YouTube

Sample Problems Bonds Directory Viewer

The price of the bond is equal to the present worth of the future stream of payments paid by the borrower to the bondholder. This consists of (1) the series of periodic interest payments, and (2) the

The Valuation and Characteristics of Bonds Thomson Learning

Breaking down a bond issue problem (present value) YouTube